Unveiling The Future: Embracing New Technology Trends In Banking For Enhanced Financial Experiences

New Technology Trends in Banking

Greetings, Readers! In this article, we will explore the exciting world of new technology trends in banking. As the banking industry continues to evolve, advancements in technology have had a significant impact on how banks operate and serve their customers. By embracing these new trends, banks are able to enhance efficiency, improve security, and provide a seamless banking experience to their customers. Let’s dive into the details and discover the latest innovations shaping the future of banking.

Introduction

1. Evolution of Banking: The banking industry has come a long way from traditional brick and mortar institutions to digital banking platforms. With the advent of new technologies, banks have been able to streamline their operations, offer innovative services, and cater to the changing needs of their customers.

3 Picture Gallery: Unveiling The Future: Embracing New Technology Trends In Banking For Enhanced Financial Experiences

2. Advancements in Artificial Intelligence (AI): AI has revolutionized the banking sector by enabling banks to automate various processes, such as customer service, fraud detection, and risk assessment. Through machine learning algorithms, banks can analyze vast amounts of data to provide personalized recommendations and improve decision-making.

Image Source: gatehub.net

3. The Rise of Mobile Banking: With the widespread use of smartphones, mobile banking has become increasingly popular. Customers can now perform a wide range of banking activities, such as checking account balances, transferring funds, and making payments, all from the convenience of their mobile devices.

4. Blockchain Technology: Blockchain technology offers a secure and transparent way to conduct financial transactions. By eliminating the need for intermediaries, such as clearinghouses, banks can reduce costs and improve the speed and efficiency of cross-border transactions.

5. Biometric Authentication: Biometric authentication methods, such as fingerprint and facial recognition, are being utilized by banks to enhance security and protect customer data. These technologies provide a higher level of security compared to traditional password-based authentication methods.

Image Source: automationedge.com

6. Robotic Process Automation (RPA): RPA involves the use of software robots to automate repetitive tasks and workflows. By automating processes like data entry and document verification, banks can improve efficiency and free up their employees to focus on more complex and value-added tasks.

7. Cloud Computing: Cloud computing has enabled banks to store and access vast amounts of data securely. By leveraging the cloud, banks can scale their operations, enhance collaboration, and reduce infrastructure costs.

What are New Technology Trends in Banking?

1. AI-Powered Chatbots: Banks are implementing AI-powered chatbots to provide instant customer support and assistance. These chatbots can understand and respond to customer queries, perform transactions, and provide personalized recommendations.

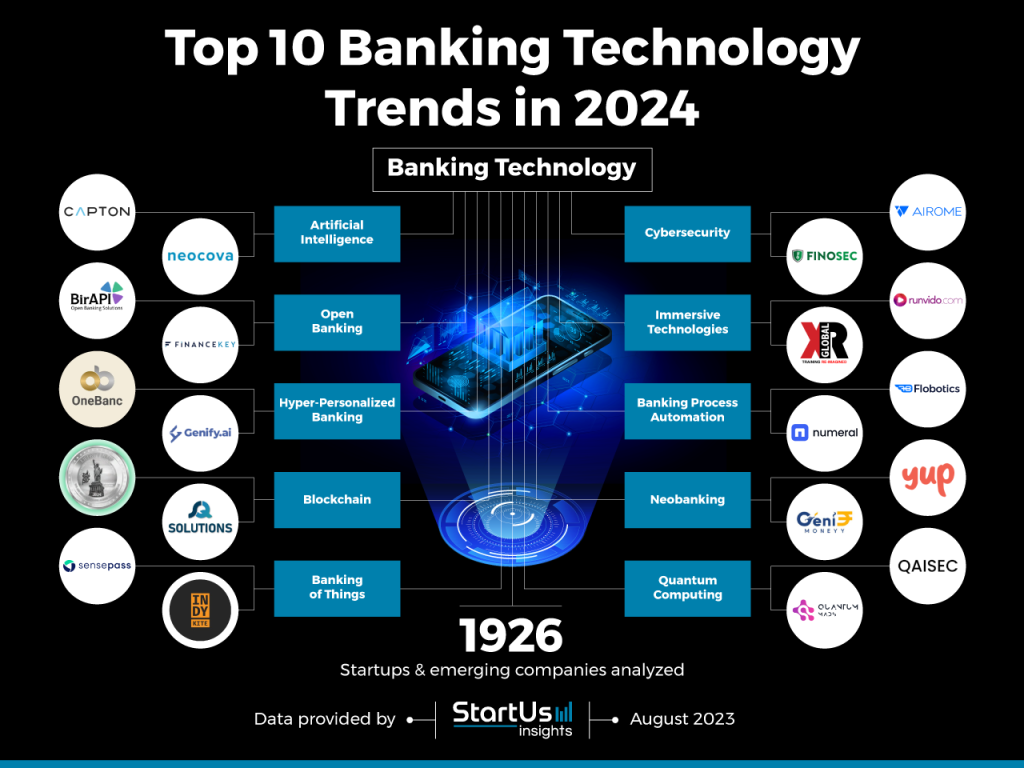

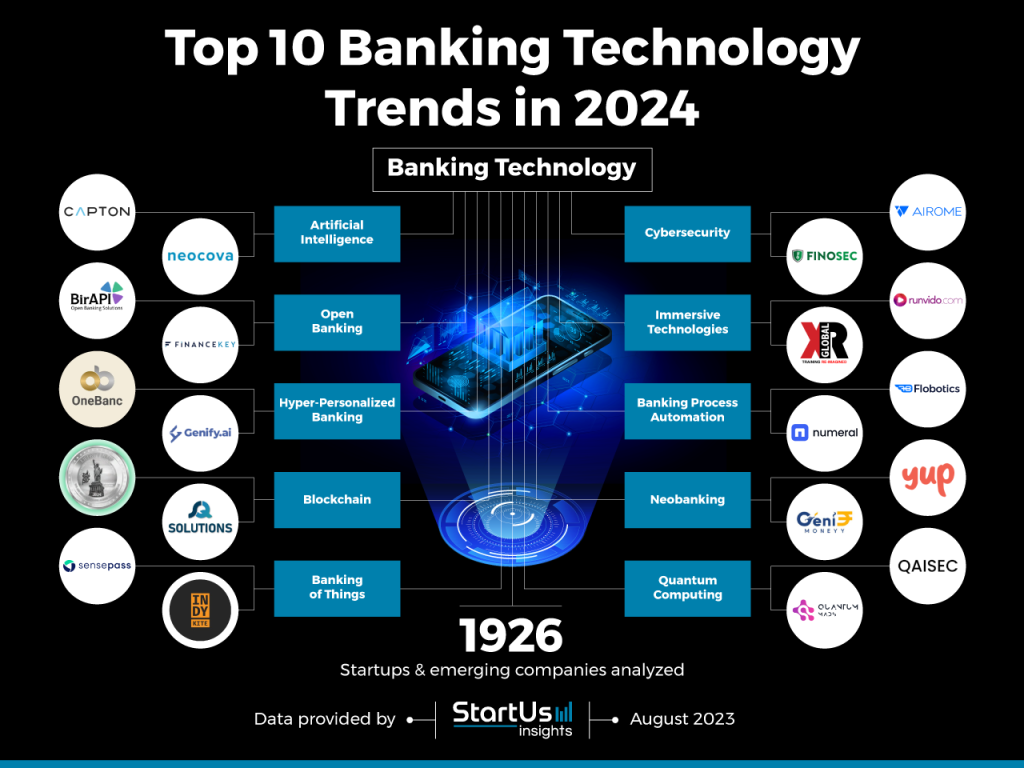

Image Source: startus-insights.com

2. Open Banking: Open banking allows customers to share their financial data securely with third-party providers, enabling them to access innovative services and products. This trend fosters competition and drives innovation in the banking industry.

3. Internet of Things (IoT) in Banking: IoT devices, such as wearables and smart appliances, are being integrated with banking systems to offer personalized services and enable secure transactions.

4. Big Data Analytics: Banks are leveraging big data analytics to gain insights into customer behavior, detect fraud, and tailor personalized offers to their customers.

5. Cybersecurity and Fraud Prevention: With the increasing threat of cybercrime, banks are investing in advanced cybersecurity measures, such as biometric authentication, encryption, and real-time fraud detection systems.

6. Virtual Reality (VR) and Augmented Reality (AR) in Banking: VR and AR technologies are being utilized to enhance the customer experience by providing immersive virtual banking environments and virtual tours of bank branches.

7. Contactless Payment Solutions: Contactless payment methods, such as mobile wallets and contactless cards, are gaining popularity due to their speed, convenience, and enhanced security features.

Advantages and Disadvantages of New Technology Trends in Banking

1. Advantages:

a. Enhanced Customer Experience: New technology trends in banking enable banks to provide personalized and seamless experiences to their customers, resulting in higher customer satisfaction.

b. Improved Efficiency: Automation and digitization of processes lead to increased efficiency, reduced manual errors, and faster transaction processing times.

c. Enhanced Security: Advanced security measures, such as biometric authentication and encryption, protect customer data and minimize the risk of fraud and identity theft.

d. Cost Savings: By leveraging technology, banks can reduce operational costs, such as infrastructure expenses and manual labor, leading to overall cost savings.

e. Increased Accessibility: Mobile banking and digital platforms provide customers with round-the-clock access to banking services, regardless of their location.

2. Disadvantages:

a. Technological Challenges: Implementing new technologies in banking requires significant investments in infrastructure, training, and cybersecurity measures.

b. Privacy Concerns: As banks collect and analyze large amounts of customer data, privacy concerns may arise, necessitating robust data protection measures.

c. Cybersecurity Risks: Increased reliance on technology exposes banks to cybersecurity threats, such as hacking and data breaches, which can have severe financial and reputational implications.

d. Digital Divide: Not all customers may have access to the internet or possess the necessary technological skills to utilize digital banking services, resulting in a digital divide.

e. Dependency on Technology: In the event of a system failure or technical glitch, customers may face disruptions in accessing their accounts and conducting transactions.

Frequently Asked Questions (FAQs)

Q1: What are the key benefits of AI in banking?

A1: AI in banking enables personalized customer experiences, improved fraud detection, automated processes, and enhanced decision-making capabilities.

Q2: How does blockchain technology improve security in banking?

A2: Blockchain technology offers secure and tamper-proof transactions, reduces the risk of fraud, and eliminates the need for intermediaries in financial transactions.

Q3: What is the role of open banking in the banking industry?

A3: Open banking allows customers to share their financial data securely with third-party providers, fostering competition, innovation, and the development of new financial products and services.

Q4: How does IoT benefit the banking sector?

A4: IoT enables banks to provide personalized services, real-time monitoring of transactions, and secure communication between devices, leading to improved customer experiences and operational efficiency.

Q5: What are the advantages of contactless payment solutions?

A5: Contactless payment solutions offer faster transaction processing, enhanced security, and increased convenience for customers, reducing the need for physical cash or cards.

Conclusion

In conclusion, new technology trends in banking have transformed the industry, offering numerous benefits to both banks and customers. From AI-powered chatbots and open banking to blockchain technology and biometric authentication, these trends have revolutionized the way banks operate, improving efficiency, security, and customer experiences. However, it is important to address the challenges associated with implementing these technologies, such as cybersecurity risks and the digital divide. By embracing these trends while mitigating potential risks, banks can stay competitive in the rapidly evolving digital landscape.

Thank you for reading, and we hope this article has provided valuable insights into the exciting world of new technology trends in banking.

Final Remarks

This article is intended for informational purposes only and should not be considered as financial or investment advice. The implementation of new technology trends in banking should be based on thorough research, analysis, and consultation with industry experts. The mentioned trends may vary in their applicability and effectiveness depending on the specific banking institution and regulatory framework. Readers are encouraged to conduct their own due diligence and seek professional guidance before making any financial decisions.

This post topic: Latest Technology Trends